Home Price Forecast 2022

To analyze the real estate market. One way involves looking at how much (or how little) home prices have changed compared to the basics. In other words, when you compare housing prices to recent changes in economic growth, income, and interest rates it tells a very different story,. so whether you’r

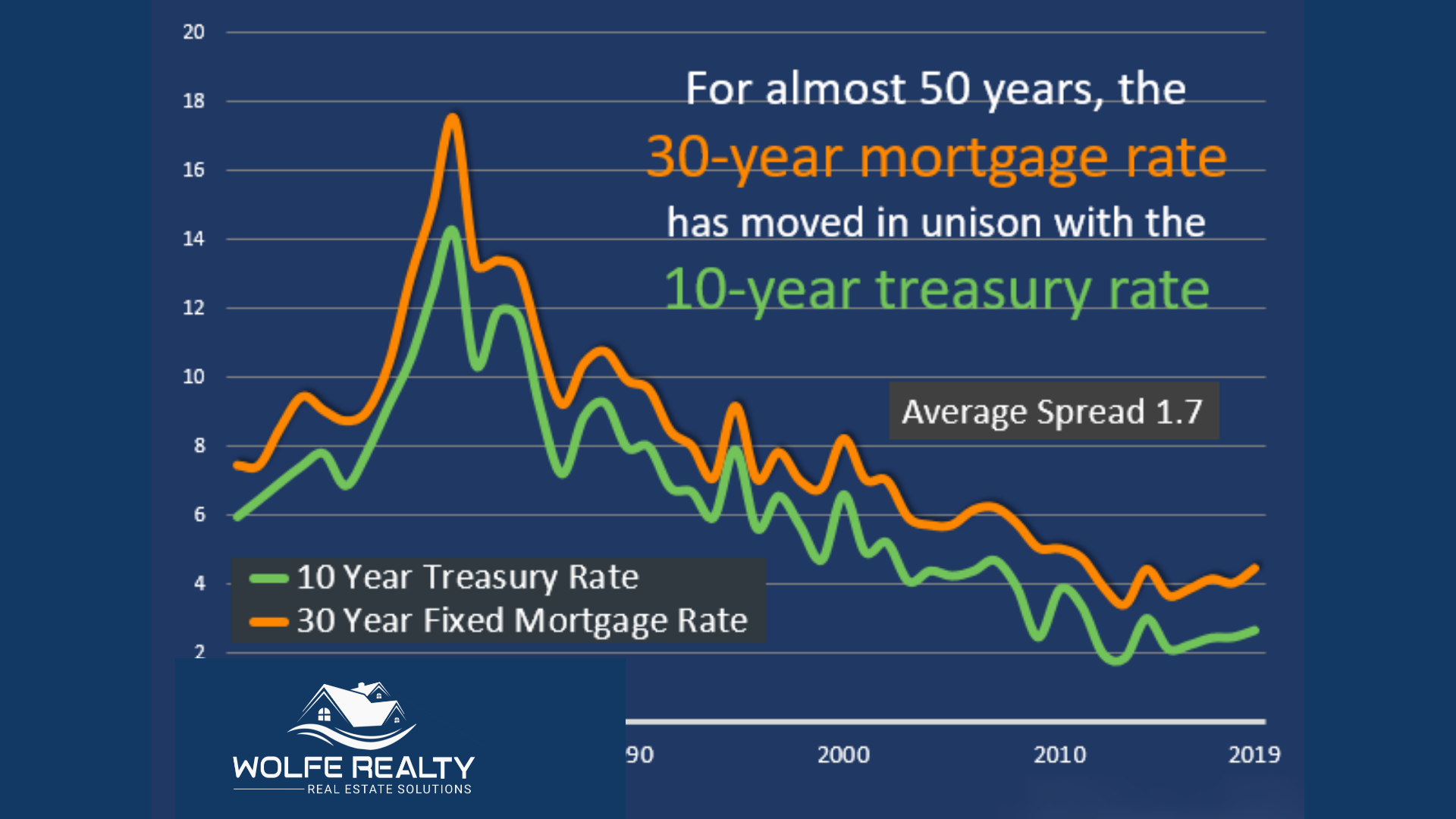

For Almost 50 Years, The 30-year Mortgage Rate Moves in Unison, The 10-Year Treasury Rate

Mortgage rates dropped due to the Federal Reserve lowering rates in response to COVID-19. Record low mortgage rates are expected to stay near all-time lows through 2020, at least according to Freddie Mac's latest forecast published November 1, 2019. Mortgage rates have fluctuated significantly in th

Renting vs. Buying A Home: What You Need To Know

Have you been considering buying a house instead of renting? It’s a tough decision—especially given the state of the economy. And, as a renter, you may be wondering if now is the right time to buy a home. In order to make an informed decision, you need to discuss several things with yourself and you

Featured 2021 Fulton Sun & Callaway County’s Best Magazine: Suzanna Wolfe Team, Wolfe Auction Service & Wolfe Realty

Recently Suzanna Wolfe was featured by 2021 Fulton San Callaway’s Best Magazine, a digital publication that showcases the paths of excellent businesses and entrepreneurs. They informed us that they had awarded #1 Best Real Estate Company in Fulton, Missouri and Callaway County on page 12, #1 Best Au

Recent Posts